Bernie Sanders on Financial Regulation

“The 2008 Wall Street bailout was never meant to help ordinary people. It only emboldened Wall Street’s greed, recklessness and fraud. Bonuses went up, no one went to jail. That’s why I voted against it. It’s time to break up the big banks once and for all.” – Bernie Sanders, May 31, 2019

Reinstate Glass-Steagall: Separating commercial banking from investment banking will protect the financial system from risky investments by big banks that can lead to economic disaster.

Break up the Big Banks: Banks that are “too big to fail” make risky investments because they know American taxpayers will bail them out. Some financial institutions are too big to exist and must be broken up.

Tax on Wall Street Speculation: The tax code should be changed to promote long-term investing and to discourage short-term gambling by speculators.

Bernie has released a Fair Banking for All plan to cap interest rates at 15% and institute postal banking to make banking services widely accessible and end lending discrimination.

Reinstate Glass-Steagall

“I was proud to lead the fight in the House against repealing the Glass-Steagall Act. I predicted then that such a massive deregulation of the financial services industry would seriously harm the economy. I would give anything to have been proven wrong about this, but unfortunately what happened to the economy during the financial collapse of 2008 was even worse than I predicted,” – Bernie July 17, 2015

Bernie supports reinstating the Glass-Steagall Act, which creates a wall between commercial banking and investment banking. Glass-Steagall was passed in 1933, in the wake of the Great Depression, to prevent banks from making risky investments with the savings deposits of average Americans and then falling back on federal deposit insurance, which protects those deposits, when their bets go bad. Glass-Steagall was repealed in 1999 when President Clinton signed the Financial Services Modernization Act. Many economists argue that the repeal of Glass-Steagall contributed to the severity of the 2008 financial crisis. Bernie opposed the repeal of Glass-Steagall, re-introduced similar legislation in the past, and co-sponsored the bipartisan 21st Century Glass-Steagall Act.

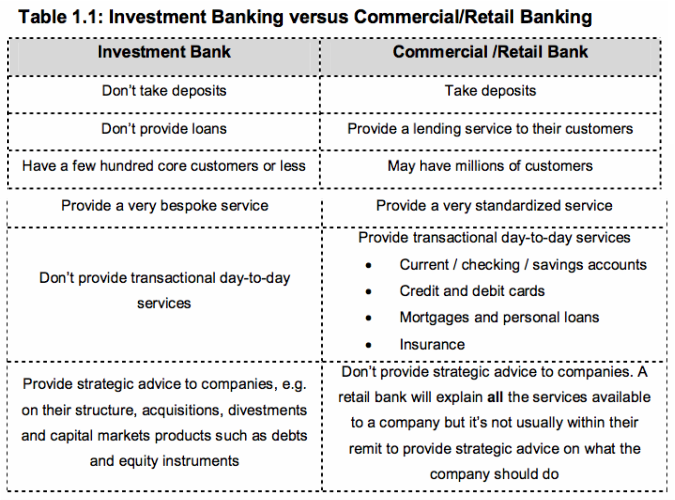

What’s the difference between commercial and investment banks?

Commercial banks take deposits and make small loans. These are the banks people use to deposit their paychecks, pay their bills, and take out loans to buy a house, start a business, or buy a car. These savings accounts are protected by a federal agency, the FDIC. What this means is that if there’s a financial crisis and a bank goes bankrupt or can’t give a customer the money they deposited there, then the federal government will pay the customer their money. Commercial banks can only make safe investments in things like government securities.

Investment banks manage the fortunes of wealthy people and large corporations. They manage hedge funds and facilitate mergers and acquisitions. They usually offer financial advice and trade complex financial assets like stocks, bonds, and derivatives. These banks are not covered by the FDIC, meaning their investments are not insured by the government.

This graphic provides a handy breakdown:

Explain this to me. What is the history of Glass-Steagall?

The era of giant national banks started when Bill Clinton signed the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994, which removed restrictions on opening bank branches across state lines. Prior to this, the McFadden Act of 1927 restricted cross-state banking and mergers to prevent banks from getting too big. On the House Financial Services Committee, Bernie cast the only “no” vote against Riegle-Neal.

In 1999, the Gramm-Leach-Bliley Act, better known as the repeal of the Glass-Steagall Act, was passed. Glass-Steagall was a post-1929 safety measure that separated commercial banks and investment banks. This rule kept banks from making speculative, risky trades with the savings accounts of average Americans and then relying on taxpayer bailouts if they lost those bets. Removing the separation freed banks to invest their regular customers’ savings in risky investments to make profits for themselves and their wealthy customers.

Politicians and bankers justified the repeal by claiming the protection for Americans’ savings accounts was no longer necessary and that “supermarket” financial institutions were needed to keep American banks competitive.

In 2003, the net capital rule that limited investment banks to borrowing 12 dollars for every one they actually had was changed. The change was due in large part to the lobbying efforts of the top five investment banks as well as Treasury Secretary Hank Paulson, who is a former CEO of Goldman Sachs. By 2008, the debt-to-equity ratios, leverage, for the big banks were 33 to 1.

Why should we care?

Combining commercial banking and investment banking puts regular people’s money at risk. Without restrictions between the two kinds of banking, the paychecks and loan payments deposited by regular people can be invested by banks in unprotected, risky investments. If those investments fail, then the money from the regular people is lost. In the case of the 2008 crisis, taxpayers had to bailout the big banks. Many experts, including Nobel Prize-winning economists Joseph Stiglitz and Paul Krugman, agree that the repeal of Glass-Steagall contributed to the 2008 global financial crisis.

Removing the wall separating commercial banking and investment banking let big banks become giant banks that have a lot of power and influence. The top 10 U.S. banks control $12.2 trillion in assets.

Check out this video where Jack Reed from Citicorp explains the influence and power of big banks.

His concern is terribly ironic because the repeal of Glass Steagall was passed to retroactively legalize the 1998 merger of Travelers Insurance, Salomon Smith Barney, and Citibank. Thanks to the merger, these three institutions fall under one roof: Citigroup.

When asked about the deal at the time:

“Are you concerned about such mergers as Travelers Insurance and Citicorp when they form a company with assets of almost $700 billion?” Sanders asked. “What happens if they fail? Who in God’s name is going to bail them out? Are you concerned about that?”

Besides being a key reason for the 2008 crisis, Citigroup hired and paid $100 million over a decade to Bob Rubin, who was the Treasury Secretary that pushed through the $700 billion bank bailout.

Another reason to care is that removing banking regulations in 1994 lead to a more than 57 percent loss of banks where normal people do their banking. Many of the closed banks were in rural communities and lower income urban neighborhoods.

Would Glass-Steagall have stopped the crisis or the bailout? Will it prevent future crises?

No. Reintroducing Glass-Steagall will help prevent abuses in the banking sector, but it will not guarantee safety against future crises. We’ll have to introduce more regulations and legislation to limit the risks banks can take — and reduce the risk posed by bank failures to the rest of the economy. It will be important to break up large financial institutions like those that are “too big to fail,” so they can be allowed to go bankrupt if they take similar risks in the future.

Sen. John McCain (R-Ariz.) said of the bipartisan support for reintroducing the Glass-Steagall protections: “I want to ensure that we never stick the American taxpayer with another $700 billion — or even larger — tab to bail out the financial industry. If big Wall Street institutions want to take part in risky transactions, fine. But we should not allow them to do so with federally insured deposits. It is time to put a stop to the taxpayer financed excesses of Wall Street.”

So, what is Bernie’s position on Glass-Steagall?

Bernie has been a strong supporter of Glass-Steagall for his entire political career. In 1999, he led the fight in the House against the law’s repeal, warning that it would lead to “taxpayer exposure to potential losses should a financial conglomerate fail.”

Bernie is also aware that Glass-Steagall, while important, is not entirely sufficient to protect against future crises. On the House Financial Services Committee Bernie cast the only “Nay” vote against allowing banks to do business across state lines.

Here’s video of Bernie in 1999 opposing the repeal of Glass-Steagall:

What specific policies does Bernie support?

He has introduced legislation to break up banks that are “too big to fail” and has been a vocal supporter of the Wall Street Trading and Speculators Tax Act. Bernie has also co-sponsored bipartisan legislation in the Senate, including the 21st Century Glass-Steagall Act, which reintroduces rules preventing banks from taking reckless risks with the savings of American families.

Bernie’s 2020 Presidential Platform includes many Wall Street reforms, including:

- Break up too-big-to-fail banks.

- End the too-big-to-jail doctrine.

- Reinstate the Glass-Steagall Act.

- Cap credit card interest rates.

- Allow every post office to offer basic and affordable banking services.

- Cap ATM fees.

- Audit the Federal Reserve and make it a more democratic institution so that it becomes responsive to the needs of ordinary Americans, not just the billionaires on Wall Street.

- Restrict rapid-fire financial speculation with a financial transactions tax.

- Reform credit rating agencies.

Employee Ownership Bank

Bernie introduced the U.S.Employee Ownership Bank Act of 2019. This bill would provide loan guarantees, direct loans, and technical assistance to employees to buy their own companies. Instead of helplessly watching their companies pack up and move overseas, employees will have the chance to get loans to buy those business and preserve their jobs. He introduced similar legislation in 2014.

No Loan Sharking Law

Bernie, along with New York House Representative Alexandria Ocasio-Cortez, has introduced a No Loan Sharking Law that would cap credit card consumer loan interest at 15%. Many states already set limits on the amount of interest credit cards can charge. For example, the limit in Vermont is 18%.

However, in states like Texas, there are no limits. The annual rate on payday loans can be as high as 661%.

There’s bipartisan support for Bernie’s No Loan Sharking Law, 68% of Republicans support it.

Bernie has said, “Last year Americans paid $113 billion in interest on credit cards—50% more than just five years ago. [Alexandria Ocasio-Cortez’s] and my plan: end Wall Street’s greed and cap credit card and other consumer loan interest rates at 15%.”

Here’s a video of Bernie with AOC discussing the No Loan Sharking Law:

Postal Banking

Bernie supports postal banking, which would allow post offices to engage in banking activities. Many European countries have already adopted a similar system. This would provide access to nondiscriminatory banking services in every community where people have been left behind by big banks.

Bernie has said, “Banks make record profits discriminating against people of color and denying basic banking services to 63 million adults who are unbanked or underbanked.We must allow every post office to offer basic, affordable banking services and end lending discrimination once and for all.”

Break Up the Big Banks

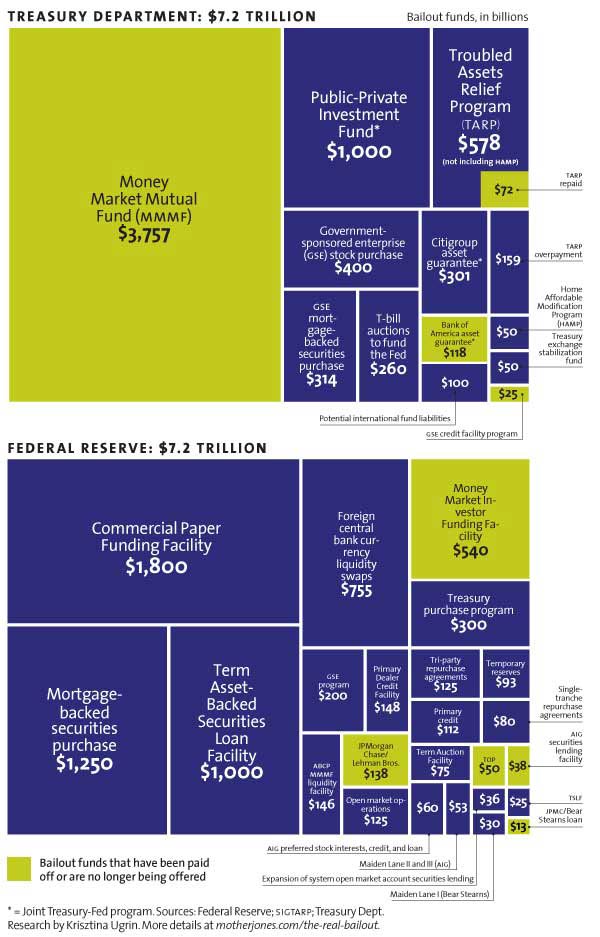

During the 2008 financial crisis, the government lent a staggering amount of support and resources — at least 14.4 trillion dollars — to financial institutions in order to prevent their collapse. If these financial giants were allowed to go bankrupt, they would have dragged the entire economy down with them. Bernie believes banks that are “too big to fail” are too big to exist.

The chart below shows the extent of assistance the big banks needed to bail them out and prevent a financial collapse of the entire economy.

Explain the problem to me in language I can understand.

When banks are so large that their bankruptcy would devastate the economy, the government is forced to give them money to prop them up and prevent them from failing. Because banks know the government has no real choice but to bail them out, they speculate, make risky investments, and enrich themselves knowing that they can’t really lose.

After the 2008 bailout of the big banks, the 2010 Dodd-Frank financial reform law was passed. In 2018 Dodd-Frank was repealed and replaced by the Economic Growth, Regulatory Relief, and Consumer Protection Act. The new law defines “big banks” as having at least $250 billion in assets.

So why break them up?

These banks should be broken up because they are too big and have too much power and influence. Big banks spent $2 billion in the 2016 election.

Breaking up the biggest financial institutions would reduce their control over the American economy and political system. Not only is it risky for the reasons stated above, but it also gives them the money to hire hundreds of lobbyists and the ability to influence Congress.

This chart shows how big some of these banks are. In total, the 10 largest U.S. banks control $12.2 trillion in assets.

What is Bernie’s position on “too big to fail”?

Bernie is a strong opponent of allowing “too big to fail” banks to exist. He criticized the 2008 bailout as “the most extreme example … of socialism for the rich and free enterprise for the poor.”

Bernie has repeatedly called for the breakup of the country’s largest banks. In 2008 he introduced the Too Big to Fail, Too Big to Exist Act, which would have required the Secretary of the Treasury to break up the nation’s largest financial institutions: JP Morgan Chase, Citigroup, Goldman Sachs, Bank of America, Morgan Stanley, and others that pose a threat to the financial system.

Here’s video of Bernie giving a speech about banks that are “too big to fail.”

Does Bernie support any other regulations for the big banks?

Bernie is a consistent supporter of strengthened bank regulations, including reintroducing Glass-Steagall, reversing tax loopholes that only help big banks, and fighting against rollbacks of banking regulations.

Tax on Wall Street Speculation

Stock markets are intended to be an exchange where a company can sell shares for cash that they then invest back in the business. But increasingly, the market is used as an instrument to gain short-term profits by quickly trading stocks with tiny price differences and using other high-risk trading methods to make a quick return. Bernie sides with several leading economists in calling for a tax on this dangerous speculation on Wall Street.

What is a Financial Transaction Tax (FTT)?

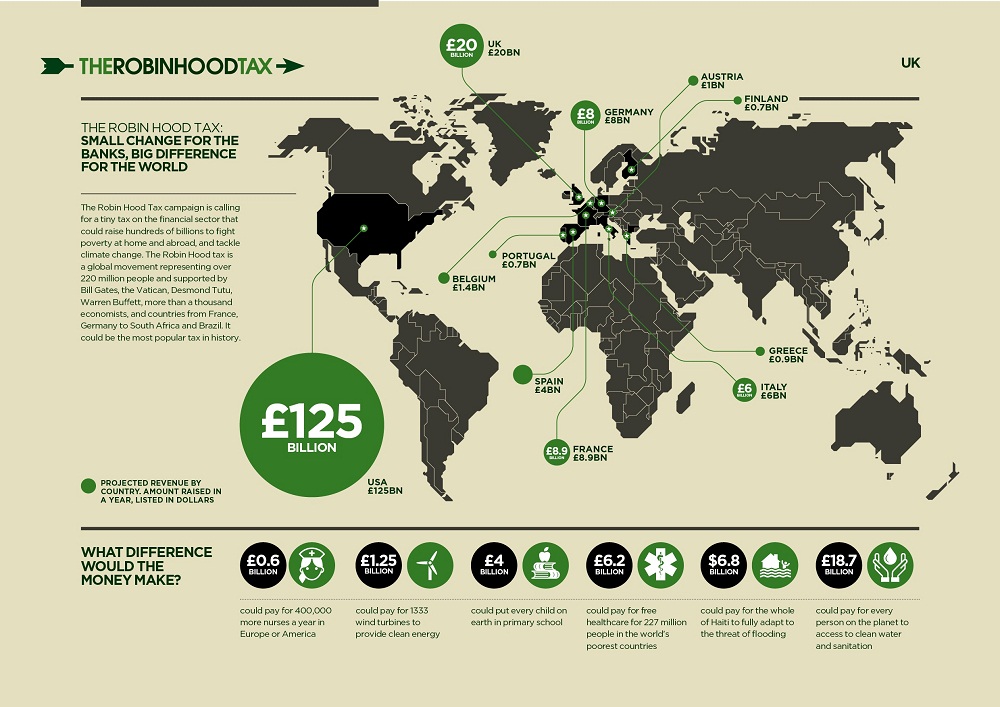

An FTT, also known as a Tobin Tax or Robin Hood Tax, is a small tax applied each time a financial security (e.g., a stock, bond, or similar financial instrument) is traded.

The 2008 financial crisis has been both a lesson in the dangers of excessively risky financial behavior and a tremendous expense for American taxpayers. Many studies show (as cited in this report) that implementing an FTT would both dissuade high-risk and high-frequency trading and generate revenue.

But wouldn’t this discourage investment?

Taxing a financial transfer does disincentivize selling a stock or bond. However, the small percentage of the tax means that only trading on the smallest of margins is no longer profitable. This tax would target the high-frequency trading that uses these tiny margins for profit without having meaningfully invested in a company.

A well-crafted FTT would only affect sophisticated stock brokers trying to make a quick buck. If done correctly, it would not discourage investment in the markets and would have no effect on the majority of investors. See here and here and here for in-depth discussions on different ways of implementing an FTT.

Here’s an illustration of how FFTs could be applied on a global scale:

So what does Bernie think about FTTs?

Bernie is strongly in favor of implementing an FTT in the U.S., saying that doing so “would reduce gambling on Wall Street, encourage the financial sector to invest in the productive economy, and significantly reduce the deficit without harming average Americans.”

Bernie’s proposed speculation tax is a financial transaction tax, which would be levied on trades of stocks, bonds, and derivatives. He wants to use the revenue to rebuild our infrastructure, improve our social safety net, and make higher education more affordable.

Bernie cosponsored the 2013 Wall Street Trading and Speculators Tax Act, which would impose a 0.3 tax on each trade of stocks, bonds and derivatives.

Bernie introduced the Inclusive Prosperity Act of 2015 and the Inclusive Prosperity Act of 2017. Both pieces of legislation proposed a small tax on each trade: 0.5 percent tax on stocks, 0.1 percent for bonds and 0.005 percent for derivatives.

Under this plan, a $1,000 stock trade would be taxed $5, a $1,000 bond trade would be taxed $1, and a trade in derivatives would be taxed $0.05. The revenue raised from this tax would fund free higher-education at public institutions and be used to reduce student debt burdens.

Bernie calls his plan a speculation tax because it is designed to discourage speculation within the market. Investors that have 401(k)s and other retirement investments in the markets keep their investments to grow over longer periods of time. Those investors would be unaffected by the proposed transaction tax. For middle-class Americans who would be affected by the FTT there would be an income tax credit to offset the speculation fee under Bernie’s plan.

The tax would only affect high-frequency traders that engage in very short-term activity. Not only would the tax raise revenue, it would also curb destabilizing micro trading that has caused flash crashes.

By some estimates, the tax would raise $600 billion over the course of a decade.

According to estimates provided by the Joint Committee on Taxation (JCT), this measure would increase revenues by about $777 billion between 2019 and 2028.

How can I find out more about how an FTT would work in the U.S.?

The Tax Policy Center, a nonpartisan joint venture between the Urban Institute and the Brookings Institution, produced a report on the topic. We recommend it: Financial Transaction Taxes in Theory and Practice.