Bernie Sanders on Corporate Regulation

“I want to welcome you to a campaign which tells the powerful special interests who control so much of our economic and political life that we will no longer tolerate the greed of Wall Street, corporate America and the billionaire class – greed which has resulted in this country having more income and wealth inequality than any other major country on earth.” – Bernie Sanders, 2020 Presidential Platform

Bernie is calling for Real Wall Street Reform. He believes that we cannot continue to allow our nation’s wealthiest corporations to avoid paying their fair share of taxes. These companies stash tens of billions of dollars in overseas tax havens while receiving billions in government subsidies and exploiting tax loopholes. Bernie believes this is fundamentally unfair and damages our economy. Instead, he argues that multinational corporations and wealthy elites must pay their taxes so we can invest that money in America’s small businesses and working people.

End Offshore Tax Havens: Corporations must pay their fair share in taxes.

End Subsidies to Big Business: The most profitable corporations do not need to be subsidized by American taxpayers.

Overturn Citizens United: Citizens United should be overturned to stop corporations from having an outsized influence on our democracy.

Support Entrepreneurship and Small Businesses: Instead of giving subsidies to multinational corporations, Bernie wants to support small and medium American businesses by providing them access to low-interest loans.

End Offshore Tax Havens

“Instead of sheltering profits in the Cayman Islands and other offshore tax havens, the largest corporations in this country must pay their fair share of taxes so that our country has the revenue we need to rebuild America and reduce the deficit. At a time when corporations are making record-breaking profits, while the middle class is disappearing and senior poverty is on the rise, the last thing we should be doing is giving huge tax breaks to profitable corporations that don’t need it.”

While the Business Roundtable and politicians complain that corporate tax rates are too high, large businesses rarely pay the 35 percent rate. In fact, many large corporations such as Amazon, General Motors, and Prudential pay no taxes at all. Many conglomerates and ultra-wealthy individuals stash their profits overseas to evade taxes. Among their tax evasion methods is establishing subsidiaries which are incorporated in foreign countries with laxer corporate tax policies. We know this is true from the Offshore Leaks, the Panama Papers, the Paradise Papers, and the Swiss Leaks.

Watch this video about how the rich hide their money to avoid taxes:

With the newly introduced tax bill taking effect, these businesses have found even more effective ways to get around paying their fair share. These companies exploit America’s infrastructure and government resources while avoiding their tax liability to maximize profits. The United States has created a climate that has allowed these corporations to prosper — and should be repaid for its role in their success.

In 2015, Bernie issued a report detailing the tax avoidance strategies and “legalized tax fraud” of large companies represented by the lobbyists, Business Roundtable. Here’s an editorial he wrote in 2015 about corporate greed.

I’m no economist. How do companies avoid paying taxes?

This video helps explain corporate tax avoidance.

The short version is that companies claim their profits are generated by a subsidiary in a country with low corporate tax rates, like Bermuda or the Cayman Islands and not in the United States. This often takes the form of a “corporate inversion,” which has become a common method of tax evasion. These are just a few examples of large American companies that have moved their legal headquarters to avoid paying taxes:

- Florida-based Burger King acquired and merged with Tim Horton’s under the umbrella company Restaurant Brands International. Now based in Canada, it could avoid $117 million in U.S. taxes by never having to pay corporate income tax on foreign profits it holds offshore.

- Ingersoll Rand reincorporated in Bermuda in 2002 and then relocated again to Ireland in 2009, all while keeping the bulk of its management and workforce in North Carolina.

- Minnesota-based Medtronic, one of the world’s largest medical technology companies, acquired Ireland-based Covidien in 2014 while maintaining its presence in Minnesota.

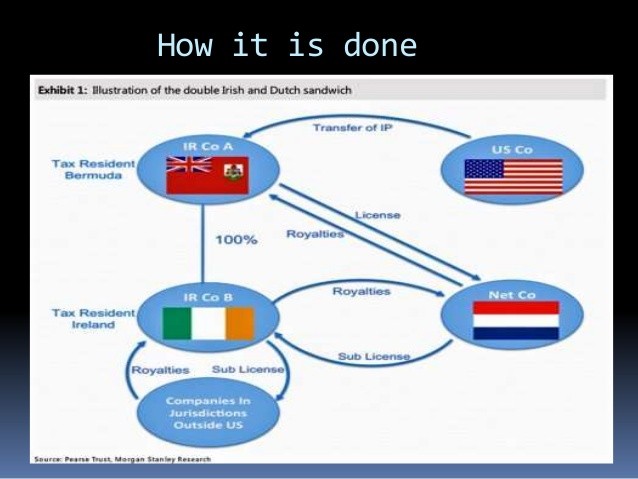

Another particularly egregious example of this strategy is known as a “double Irish” or a “Dutch Sandwich,” which cheats not only America out of tax revenue but also Ireland. This is done by shuffling profits and product origins between Ireland, the Netherlands, and the Cayman Islands or Bermuda.

I love companies like Amazon and Google. Why should I care?

For one thing, it costs you, as an American taxpayer! There’s an estimated $2.1 trillion in profits held in tax havens, which studies estimate amount to $200 billion of lost tax revenue each year. In 2008 a U.S. Senate investigation put the figure at $100 billion. That’s three times what our federal government spends on transportation each year. To put that in perspective, the cost of repairing all of the nation’s 47,000 structurally deficient bridges is estimated to be $171 billion.

This is also tremendously unfair, especially to American small businesses. These multinational corporations have built themselves up on the infrastructure and education system provided by the U.S. government and paid for by American citizens, but are now stashing their profits overseas to avoid repaying what they owe. Several of these corporations have taken advantage of not only our infrastructure, but also our bailout funds and tax breaks, all while keeping their profits overseas.

“Our Wall Street friends might also want to show some courage of their own by suggesting that the wealthiest people in this country, like them, start paying their fair share of taxes. They might work to end the outrageous corporate loopholes, tax havens and outsourcing provisions that their lobbyists have littered throughout the tax code – contributing greatly to our deficit,” Sanders added.

In 2017 taxes on corporate profits earned offshore were cut – from 35 percent to a one-time rate of 15.5 percent on cash and 8 percent on other assets. This gives large companies a huge tax break. In 2017, companies brought back a total of $155.1 billion in offshore cash. In 2018 companies repatriated $664.9 billion. This is at least a $108.2 billion loss in tax revenue and Bernie said that’s what would happen.

But I keep hearing that we have the “highest corporate tax rates” in the world?

The official corporate tax rate is 35 percent, but corporations rarely pay the full rate for the reasons outlined above. The “effective tax rate” is a more accurate measure of tax liabilities. The nonpartisan Government Accountability Office found that when all forms of taxes are included and divided by taxable income, the most profitable corporations paid an average of 13% in income taxes in 2010. That put the U.S. well below most developed countries as the graph below shows:

Check out this study from the Cato Institute, a libertarian think-tank founded by Charles Koch, co-owner of Koch Industries. In it, the researchers conclude that “corporate welfare in the federal budget costs taxpayers almost $100 billion a year.”

It should be noted that the corporate effective tax rate has been going down, and down and down.

Corporations used to pay a lot more in taxes. Despite record breaking profits, the share of the federal budget paid by corporate income tax is down from 33 percent in 1950 to just 9 percent today.

So what does Bernie have to say about all of this?

Bernie called out Amazon for paying no taxes in 2018. Similarly, he has called out many others including Chevron, Deere, Delta, Duke Energy, Eli Lilly, Gannett, General Motors, Goodyear, Honeywell, JetBlue, Kinder Morgan, MGM Resorts, Netflix, Prudential Financial, and Whirlpool for completely evading federal income taxes in 2018.

Bernie has publicly called out some of the worst tax-dodgers for their hypocrisy. In 2012, 80 corporate CEOs published a letter in the Wall Street Journal calling for cuts in Medicare and Medicaid in order to reduce the federal deficit.

Bernie responded by publishing a report — Top Corporate Tax Dodgers: Meet a few of the job destroyers and tax evaders that want to cut Social Security, Medicare, and Medicaid while lowering the tax rate for the top 2%.

Bernie has been calling out companies for tax avoidance for a long time. In a 2011 editorial Bernie wrote:

“Today, the U.S. government is actually rewarding companies that move U.S. manufacturing jobs overseas through loopholes in the tax code known as deferral and foreign source income. This is unacceptable.” He continued, “The last thing we should be doing is providing a tax break to companies that move jobs overseas. Ending these tax loopholes could raise more than $400 billion over a 10-year period.”

As ranking member of the Senate Budget Committee, Bernie issued an official report that outlines some of the worst corporate offenders:

- Citigroup received $2.5 trillion of taxpayer bailout funds, stashed $43.8 billion of profits overseas, and would owe $11.7 billion if and when this money is repatriated.

- Bank of America received $1.3 trillion in bailout funds but holds $17 billion of profits offshore (in 143 tax haven subsidiaries in the Cayman Islands alone). That amounts to an outstanding tax bill of $4.3 billion.

- IBM has $52.3 billion in profits held offshore but gets $13.2 billion in tax breaks for a 5.8 percent effective tax rate. Again, the full corporate rate is 35 percent.

- Boeing got $9.6 billion in tax breaks for a total tax refund of $401 million between 2008 and 2013, despite claiming $26.4 billion in profits over this period.

- General Electric would have paid $14.8 billion more in federal income taxes than it did between 2008 and 2013 if it had paid the full 35 percent federal income tax rate — to say nothing of the $16 billion bailout it received during the financial crisis.

- Verizon got $15.6 billion of tax breaks on its $42.5 billion of profits from 2008 to 2013 to net a total refund of $732 million over this period, all while cutting 62,000 jobs in the U.S.

What does Bernie suggest we do about it?

Bernie’s 2020 Presidential platform includes what he calls “Real Wall Street Reform”. Among other things, Bernie wants to:

- Break up the banks considered “too big to fail”

- Reinstate Glass-Steagall

- Cap credit card interest rates

- Create a postal banking system

- Cap ATM withdrawal fees

- Audit the Federal Reserve

- Institute a financial transactions tax

Bernie introduced the Corporate Tax Dodging Prevention Act, which would prevent corporations from hiding profits in tax havens like Bermuda and the Cayman Islands and stops giving tax breaks to companies that ship jobs overseas. In this statement he lists the specific tax loopholes he intends to close.

Bernie supported the Corporate Tax Fairness Act, which would require U.S. companies to pay taxes on all of their income by ending the deferral of foreign source income. He also co-sponsored the Stop Corporate Inversions Act of 2015 and 2017, which would stop corporations from buying a smaller foreign business and moving their tax “domicile” (address for tax purposes) overseas.

Bernie sent a letter to Obama and Treasury Secretary Jack Lew asking for the elimination of six corporate tax breaks: the check-the-box loophole, the Hewlett-Packard loophole, corporate inversions, the carried interest loophole, valuation discounts, and the real estate investment trust (REIT).

Bernie has a variety of plans to make sure the wealthiest Americans and most profitable corporations pay their fair share of taxes:

- Establish a progressive estate tax

- Pass the Corporate Tax Dodging Prevention Act

- Tax Wall Street speculation

- Eliminate the income cap on Social Security payroll taxes

- End special tax breaks on capital gains and dividends for the top 1%

- Increase the top marginal tax rate on income above $10 million

- Close tax loopholes that benefit the wealthy and large corporations

End Subsidies to Big Business

Bernie finds it outrageous that the most profitable corporations continue to receive billions of dollars in taxpayer subsidies each year. He has fought for years to limit these unfair benefits and has consistently refused to accept money from corporations, calling it “legalized bribery.”

Are we really giving billions of dollars in taxpayer money to the most profitable corporations?

Yes. Study after study after study reveals the astonishing extent to which we subsidize big business. While the details differ each year, a recent study concludes: “Over the past 15 years, the federal government has provided $68 billion in grants and special tax credits to business, with two-thirds of the total going to large corporations.”

The corporations get taxpayer dollars as a result of many policies. Here are a few:

- State and local subsidies

- Direct federal subsidies

- Federal tax breaks

- Mortgage deduction

- Government bailout of Wall Street

- Thousands specialized tax breaks for corporations and businesses

- Companies pay fees or fines instead of being criminally prosecuted

I don’t understand. Why?

In theory, these incentives encourage corporations to keep their businesses in the U.S. and provide jobs to American workers. “Economic development incentives” is a more neutral term for this policy.

But does it work?

Not really. According to a Harvard Business Review study, large corporations are not using the extra money to invest in American jobs. As the author details, after WWII, businesses retained-and-reinvested profits to give workers higher incomes and greater job security. But, in the late 1970s, businesses changed to a model of downsize-and-distribute to reduce costs and distributing profits to financial interests, particularly shareholders. Essentially, businesses use any free cash to pay CEOs million-dollar salaries and to inflate their own stock prices instead of creating jobs or giving their employees raises.

A recent study by the W.E. Upjohn Institute for Employment Research found that giving taxpayer money to corporations to increase jobs actually has the opposite effect. The study found that “establishments that received an incentive experienced employment growth that was 3.7 percent slower than non-incentivized establishments.”

How does Bernie plan on taking on these corporations?

Bernie speaks out against all types for corporate welfare, but he finds the government subsidies given to the fossil fuel industry to be particularly egregious. Oil Change International finds that over $21 billion in production and exploration subsidies are given to oil, coal and gas companies each year. Bernie introduced legislation to end these subsidies and save taxpayers over $135 billion over ten years. You can read more about Bernie’s energy policy at our Climate Change and Energy Policy issue pages.

Bernie introduced the End Polluter Welfare Act in 2012, and then re-introduced it in 2013 and 2015.

Recently, Bernie has spoken out about large corporations such as Amazon taking advantage of corporate welfare while paying their employees so little they are forced to “rely on food stamps, Medicaid or public housing in order to survive.” Some of the wealthiest corporations on earth are taking advantage of taxpayer money to help “get richer because of taxpayer support for their low-paid employees.”

Bernie has also introduced a new bill in the Senate to stop corporations from underpaying their workers.

What does “Welfare for Walmart” mean?

The Walton family, Walmart’s largest shareholders, is the wealthiest family in America, estimated to be worth $175 billion.

Walmart is one of the largest, most profitable corporations in the United States, yet it does not pay their workers a living wage and keeps workers as part time employees to avoid providing healthcare benefits. Many Walmart workers rely on Medicaid for health insurance and food stamps to feed their families which are paid for by taxpayers, to the tune of $6.2 billion each year. Bernie has called this “Welfare for Walmart.”

In this video of a 2014 hearing Bernie asks some pertinent questions about Walmart and the minimum wage:

In 2019, Bernie was invited to speak on behalf of Walmart workers at a shareholder meeting.

The Minimum Wage issue page has information about Bernie’s proposal to more-than-double the federal minimum wage to $15.

What is the Stop BEZOS Act?

In 2019, Bernie introduced the Stop Bad Employers by Zeroing Out Subsidies (Stop BEZOS) Act, which would tax large companies equal to the amount their employees rely on Section 8 housing, food stamps, and other welfare programs. For example, Amazon would pay a corporate welfare tax of $100 for every warehouse worker that relies on $100 in food stamps to feed their family. Bernie cosponsored a similar bill in the House in 2005.

Bernie said, “At a time of massive income and wealth inequality, when the 3 wealthiest people in America own more wealth than the bottom 50 percent and when 52 percent of all new income goes to the top one percent, the American people are tired of subsidizing multi-billionaires who own some of the largest and most profitable corporations in America.”

In this video, Bernie talks about corporate welfare where companies like Amazon and Walmart burden the public assistance system by underpaying their employees.

What is the Export-Import Bank?

It provides subsidized financing to American businesses doing business overseas. Head over to Vox to read a thorough explanation.

Bernie has opposed the Export-Import Bank’s for many years. Here he is back in 2002:

As Bernie argues in the above video, the Export-Import Bank’s track record isn’t great. Year after year, the vast majority of benefits have gone to a few large corporations that ship American jobs overseas. For example, in 2013, nearly one-third of all its financing went to Boeing.

In 2001, Bernie introduced an amendment to stop giving loans from the Export-Import Bank to businesses that shipped American jobs overseas while keeping credit available for small businesses here in the U.S.

Nearly 15 years later in June 2015, Bernie said:

“Instead of providing low-interest loans to multinational companies that are shipping jobs to China and other low-wage countries, we should be investing in small businesses and worker-owned enterprises that want to create jobs in the United States of America. If the Export-Import Bank cannot be reformed to become a vehicle for real job creation in the United States, it should be eliminated.”

This article explains why Bernie voted against the Senate confirmations of Judith DelZoppo Pryor and Kimberly Reed to the Export-Import Bank’s board of directors. Bernie said, “I am not convinced that any of the nominees of the Export-Import Bank will make the types of reforms we need to grow jobs in the United States. At a time when almost every major corporation in this country has shut down plants and outsourced millions of American jobs, we should not be providing corporate welfare to some of the biggest job outsourcers in this country.”

Overturning Citizens United

Bernie wants to implement comprehensive campaign finance reform by passing a constitutional amendment to overturn Citizens United — a Supreme Court decision that allows corporations and the super-rich to spend unlimited money on election campaigns — and move toward public funding of elections.

Why does Bernie want comprehensive campaign finance reform?

Right now, wealthy corporations have enormous power to influence campaigns and elections. This gives them an outsized voice in lawmaking and policy — and stifles the voice of ordinary Americans.

Haven’t the wealthiest people always had more influence on our government?

Yes. That’s why Bernie has called for campaign finance reform for years. Here he is in 2002:

So, how will he overturn Citizens United and what does public funding of elections mean?

Glad you asked. Check out all the details at the Political Reform page.

Support Entrepreneurship and Small Businesses

Bernie has emphasized the importance of supporting America’s small businesses. He believes that our government favors multinational corporations and huge conglomerates in their quest for unlimited profits — over innovation and domestic economic stability.

Specifically, how has Bernie supported small businesses?

In general, all policies that Bernie supports have the indirect purpose of helping small businesses to compete with large or international corporations. To name a few, in addition to policies mentioned above such as reforming the Export-Import Bank, Bernie supports efforts to raise the minimum wage, legalize and protect immigrant workers, and reform disastrous trade deals which only benefit multinational corporations.

Bernie voted against the Bankruptcy Prevention and Consumer Protection Act of 2005, that made it more difficult for low-income people and entrepreneurs to discharge debt from credit card companies.

In his Six-Point Plan to rein in Wall Street, Bernie advocated for laws to hold small business loan interest rates to the same rate offered by the Federal Reserve to foreign banks. Leveling the rates would allow small businesses to finance their own growth. It would also create an incentive for investors to invest in domestic small businesses. This would result in more growth in the domestic economy instead of making investments overseas with little incentive to reinvest that money back in the U.S.

Additionally, Bernie helped pass the Small Business Jobs Act, which gave low interest loans to small businesses and supported the small community banks through which the loans were disbursed. The legislation also offered $12 billion in tax relief to small businesses across the United States and an additional $30 billion in capital for small businesses during the 2010 economic crisis.

Bernie also supported the Small Business Jobs and Tax Relief Act in 2012 that would have authorized tax breaks for small businesses.

Bernie believes that fair banking is essential to helping small businesses get started. He wants to cap the interest rate that banks can legally charge customers and institute a postal banking system.

In May 2019, Bernie and Representative Alexandria Ocasio-Cortez of New York unveiled the Loan Shark Prevention Act. This legislation would cap interest rates for consumer loans and credit cards at 15%. With lower interest rates, entrepreneurs and small business owners would have better access to the credit they need to build and grow their companies.

Check out the Small Business issue page for specific policies geared towards boosting small businesses as well as the Financial Regulation page for more details about Bernie’s ideas for alternative banking options.