Bernie Sanders on Economic Inequality

The main goal of Bernie Sanders’ decades-long career in politics has been to address the root causes of economic inequality because, as he has stated, “The middle class of this country, over the last forty years, has been disappearing.”

Bernie is advocating for policies that get at the root causes of these inequities.

He calls for expanding the social safety net, creating more well-paying jobs, and reforming systems that perpetuate inequality such as our broken criminal justice system. The other side of the coin is that the super-rich and large corporations do not pay their fair share in taxes, instead they horde their wealth and stash it in overseas tax havens. Bernie wants to reform the tax code by removing tax loopholes and tax breaks that only benefit the rich and large corporations, raising the tax rates for the wealthiest Americans, taxing the fortunes of the top 0.2%, taxing capital gains and qualified dividends income as ordinary income, and taxing Wall Street speculation.

With a tax system reformed in these ways, the wealthy will disgorge some of the profits they have amassed and we will have the resources to fund good schools, affordable housing, a modernized infrastructure, healthy communities and a system that can treat the poor, elderly and sick with the dignity that they deserve.

As one measure to help reduce income inequality, Bernie has released an Income Inequality Tax plan so corporations will invest in their workers, not just dividends, stock buybacks and outrageous compensation packages to their executives. Another measure Bernie is proposing is an annual 0.1% Tax on Extreme Wealth to reduce inequality and rebuild the middle class.

According to Bernie, the main steps to achieving economic justice are:

Acknowledging Disparity of Wealth & Opportunity in America: The rich get richer and the poor get poorer because of government policies that benefit the very few at the expense of the vast majority of Americans.

Fixing the Tax Code for Citizens, Corporations & Banks: Rich people and the largest corporations don’t pay their fair share of taxes, which means there’s not enough funding for programs that will alleviate systemic inequalities.

Expanding the Social Safety Net & Increasing Access to Opportunity: The revenue generated from Bernie’s progressive tax plan will be used to expand and create programs to help alleviate poverty and move us forward to a more robust, equitable economy.

Creating & Keeping Better Jobs: Increase the minimum wage so every working American can provide for their family. Create more good paying jobs by putting people to work repairing and modernizing our country’s crumbling infrastructure.

Reforming the Broken Criminal Justice & Immigration Systems: These systems perpetuate inequality, particularly among people of color, so we see crime and poverty instead of community and economic opportunity. These systems must be revamped from the ground-up.

Bernie thinks wealth and income inequality is so important, he made this video to lay out all the major points regarding the dwindling middle class, the state of the wealth and income gaps today, and lays out how we might build a more equitable economy for all.

Acknowledging Disparity of Wealth & Opportunity in America

The first step is to acknowledge that America has a structural economic inequality problem. Income inequality is the highest it has been since the Great Depression.

Currently, 0.3 percent of the wealth is owned by the bottom 40 percent of Americans, while 84 percent of the wealth is in the hands of the top 20 percent.

Millions of Americans are just one missed paycheck away from going into poverty, and 40% of Americans can’t afford a $400 emergency.

Does this have something to do with the 99% thing?

Absolutely. Today, the United States sees vast inequalities in both income (what we get paid) and wealth (what we own). While some inequality is expected in any economy — and is perhaps even healthy — the U.S. today has structural inequalities that allow those at the top to amass (and keep) huge fortunes and estates while 41 percent of children are low-income and 19 percent live below the poverty line. Adults can work 40 hours a week and still not make enough to feed their families, while corporate executives in many of those same companies make much, much more.

The richest 10 percent of households have 70 percent of the wealth. The top 1% have increased their share of the wealth from 23% in 1989 to nearly 32% in 2018. The three wealthiest people in the U.S. own more wealth than the bottom 50% of Americans – 160 million people.

Bernie believes this is unjust and is calling for a downward transfer of wealth. In his own words:

“Ninety-nine percent of all new income generated today goes to the top 1 percent. The top one-tenth of 1 percent owns as much as wealth as the bottom 90 percent. Does anybody think that that is the kind of economy this country should have? Do we think it’s moral?”

This 2014 infographic shows the state of wealth distribution in the U.S.

The chart above shows us just how strange our wealth distribution is. Wealth is someone’s combined assets: money, property, cars, stocks, etc. We see that the bottom 90 percent control less than one fourth of the wealth. The top 0.1 percent controls 21.5 percent, which is over one fifth. The amount controlled by the top 0.1 percent (the top one-tenth of one percent) is the largest it has been in over a century. Even higher than it was in the “Roaring Twenties”.

But what about income? Is that more balanced?

It isn’t quite as bad — but it’s still pretty bad. The following infographic shows the average income for the same groups of the U.S.:

The bottom 50 percent made $31,561.49 on average in 2017. According to the National Center for Childhood Poverty, some 22 percent of American children live below the poverty level of $25,100 a year for a family of four. Research shows that to cover basic expenses, a family of four needs at least $44,700 a year, a sum which is nearly twice the poverty level. Learn more about where Bernie stands on issues affecting working Americans at the Working People page.

Fixing the Tax Code

“If you have seen a massive transfer of wealth from the middle class to the top one-tenth of 1 percent, you know what, we’ve got to transfer that back if we’re going to have a vibrant middle class. And you do that in a lot of ways. Certainly one way is tax policy.” — Bernie Sanders, 2015

Currently, the super-rich and the largest corporations in America don’t pay their fair share of taxes, which means there’s not enough money in the budget to fund programs that will alleviate systemic inequalities. The tax code needs to be reformed to enable us to break out of this vicious cycle and enable more people to have economic opportunities so we can build an even stronger and more equitable economy.

How would Bernie’s tax policy work?

Bernie has many ideas, but here are some major parts of his plan for fairer taxation:

- Progressive income taxes on the richest Americans.

- The 99.8% Tax: a tax on the fortunes of the top 0.2%.

- Taxing corporations so they can’t hide their money in overseas tax havens.

- Taxing Wall Street speculation with a small transaction fee on each trade.

- Tax capital gains and qualified dividends income as ordinary income.

Who are the “richest Americans”?

The richest Americans qualify for the top income tax bracket. Right now, the top tax bracket begins with income over $510,300. Any money earned above $510,300 is taxed at 37 percent for individuals. The top marginal bracket for married couples who file jointly starts at money earned above $612,350.

Does this mean these individuals pay 37 percent of their entire income in taxes?

Not at all. It means that money earned beyond $510,300 is taxed at 37 percent. The first $510,300 they make is taxed at the lower tax bracket rates. It works like this: 10% tax on income up $9,525, then 12% on income between $9,526 and $38,799, and so on. This is actually how all tax brackets work in our tax system which is a progressive tax system.

I heard Bernie wants a 90 percent for rich people. That seems too high.

That’s not true. Bernie has never said he wants to do that. He recently said that he is “working right now on a comprehensive tax package, which I suspect will, for the top marginal rates, go over 50 percent.”

But has it ever been that high?

Actually, yes. The top marginal tax rate was over 90 percent for most years from 1944 until 1964. Today’s income tax rates are strikingly low, especially for rich people.

I’ve heard something about ‘capital gains’ and ‘dividends’… Is that related to this?

Yes. Capital gains and dividends are sources of income almost exclusively made by the wealthiest Americans. Capital gains are profits made through the sale of assets (usually stocks, business shares, land or collectible art). Dividends are shares of profit paid to stockholders of profitable stocks. While historically these were taxed at similar rates to normal income, since the 1970’s the tax rates have been lowered dramatically.

Why does this matter?

According to the Tax Policy Center, “the benefits of low tax rates on capital gains accrue disproportionately to the wealthy. In 2013, an estimated 94 percent of the tax benefit of low rates on capital gains will go to taxpayers with cash incomes over $200,000, and three-fourths of the benefits will accrue to millionaires.”

How much revenue can raising taxes on dividends and capital gains yield?

Bernie wants to increase income taxes on the richest Americans so that they finally pay their fair share of taxes to fund America’s budget. Much of rich people’s income is not earned income from a wage, but rather income from investments, which is currently taxed at a comparatively low rate. Bernie wants to tax capital gains and qualified dividends income as ordinary income which would raise at least $265 billion over ten years. If the highest tax rates are raised, most people would be completely unaffected. Only the people doing really well and making a lot of money would see their taxes raised.

Wow. So what other ways can we address inequality?

For one, reforming the estate tax.

OK, what’s the estate tax?

The estate tax is a tax on someone’s estate which is all of the money and property owned by a particular person, after they pass away.

The estate tax is already progressive. Small estates aren’t taxed. If your estate is worth $11.4 million or more, then you are going to have to pay federal estate tax.

An estate tax, also known as the “billionaire tax,” may be the fairest way to begin reducing the federal deficit. Right now, only the very wealthiest millionaires and billionaires pay federal estate taxes. In 2017, all estates under $11.2 million per individual and $22.4 million per couple paid no estate tax.

While for many years this tax unfairly affected the estates and farms of many working- and middle-class Americans, it has been significantly changed to only affect large estates, worth over several millions of dollars. The problem is that the rate has been lowered and the cap raised to such an extent that it amounts to a huge tax break for the super-rich.

Bernie wants to tax estates so rich people cannot just make obscene amounts of money and profits, then stash it away in estates which are passed on across generations of heirs, without ever paying taxes.

Shouldn’t people be able to pass on money to their children?

They should. In Bernie’s view, estate taxes are fair — and necessary — to prevent what former Labor Secretary Robert Reich calls “an aristocracy of wealth populated by heirs who don’t have to work for a living yet have great influence over how the nation’s productive assets are deployed.”

Both Bernie and Former Secretary Reich believe that if the richest families accrue massive fortunes over time, they will control more and more of the economy — even if they aren’t working. Second, these taxes are large, but for estates this large, they’ll hardly be bankrupting heirs.

What is Bernie’s answer to reforming the estate tax?

Bernie has proposed lowering the bar on estate taxes, so individuals’ estates worth more than $3.5 million and couples’ estates worth more than $7 million will be affected. This bill also increases the amount of tax on these estates, and closes loopholes used to avoid paying these taxes.

Under Bernie’s plan, 99.75 percent of Americans would not pay a penny more in estate taxes.

How much revenue can raising the estate tax yield?

In 2010, Bernie estimated that it would raise over $319 billion over ten years. That number would certainly be higher now.

Anything else?

If you have a few minutes, you should really watch this video from 2005, where Bernie railed against fellow lawmakers who were debating repealing the estate tax. The “I’m listening! I don’t hear an answer!” part is as good as C-SPAN gets:

What about corporate taxes and regulation?

Bernie has spoken out about corporations paying far too little in taxes, and even receiving benefits from the IRS. This is not very surprising. Corporations should pay their fair share in taxes. Not only are particular corporations not paying much in taxes, but the contributions of corporations to our tax revenue is at a historical low, as shown in this Politifact analysis of Bernie’s policy proposals.

How do companies avoid paying taxes?

The short answer is that companies claim that their profits are generated not by their headquarters or their facilities in the United States, but by a subsidiary in a locale with low corporate tax rates such as Bermuda or the Cayman Islands.

Longer answers are available at the Corporate Regulation and Financial Regulation issue pages.

Why should we care?

For one thing, it costs you, as an American taxpayer! There’s an estimated $2.1 trillion in profits held in tax havens, which studies estimate amounted to $200 billion of lost tax revenue each year. In 2008, a U.S. Senate investigation put the figure at $100 billion. That’s three times what our federal government spends on transportation each year. To put that in perspective, the cost of repairing all of the nation’s 47,000 structurally deficient bridges is estimated to be $171 billion. It’s also tremendously unfair to society. These companies have built themselves up on an infrastructure and educational system provided by the government, paid for by our taxes, and are now stashing their profits overseas to avoid repaying what they owe in return.

What is Bernie’s position on corporate “tax dodging”?

Bernie feels that this is essentially legalized tax fraud, where companies abuse the concept of corporate residency to take advantage of U.S. benefits without paying their fair share in return. Many of them even end up being owed money by the IRS after filing their U.S. returns, effectively taking a direct subsidy in return for hiding their money and cutting jobs in the U.S.

What does Bernie suggest we do about it?

Bernie introduced the Corporate Tax Dodging Prevention Act, which would prevent corporations from hiding profits in tax havens like Bermuda and the Cayman Islands and stops giving tax breaks to companies that ship jobs overseas. In this statement he lists the specific tax loopholes he intends to close.

Bernie supported the Corporate Tax Fairness Act, which would require U.S. companies to pay taxes on all of their income by ending the deferral of foreign source income. He also co-sponsored the Stop Corporate Inversions Act of 2015 and 2017, which would stop corporations from buying a smaller foreign business and moving their tax “domicile” (address for tax purposes) overseas.

And you can learn how Bernie’s progressive taxation policies could help balance our budget at the Federal Budget issue page

What about tax subsidies to profitable corporations?

“The American people are asking how can it be that at a time when so many in Congress are calling for savage cuts to Medicare, Medicaid, and Social Security, and when they tell us we can’t renew key incentives for solar and wind and other sustainable technologies, that we can somehow afford to continue to pumping tens of billions in taxpayer dollars into hugely profitable fossil fuel corporations.”

Are we really giving away that much taxpayer money to fossil fuel companies?

Yes. If the current tax system remains unchanged, we’ll spend over $135 billion over the next ten years. See this extensive fact sheet for details.

What has Bernie tried to do about it?

Bernie introduced the End Polluter Welfare Act in 2012, and then re-introduced it in 2013 and 2015. This legislation would save taxpayers over $135 billion over ten years. You can read more about Bernie’s energy policy at our Climate Change and Energy Policy issue pages.

OK, and what about banks? Didn’t they contribute to our last economic meltdown in 2008?

Good question. Stock markets are intended to be a place where a company can go exchange shares of ownership in return for working capital. But increasingly, the markets are used as a place to gain short term profits by quickly trading stocks with tiny price differences and using other high-risk trading methods to make a quick return. That’s a big part of what happened in 2008.

So, what has Bernie said about this?

There are many videos showing Bernie lashing out at the big banks for causing the financial crisis. Here is one of our favorites from Bernie’s famous filibuster speech in 2010. His disgust with the “crooks on Wall Street” is palpable.

So, how does Bernie propose we deal with Wall Street?

He’s proposed a Financial Transaction Tax (FTT), also known as a Tobin Tax or Robin Hood Tax. This is a small tax applied each time a financial security (e.g., a stock, bond, or similar financial instrument) is traded.

Would this really work?

The market crash of 2007–2008 has been both a lesson in the dangers of excessively risky financial behavior, and a tremendous expense for American taxpayers who paid to bail out the banks. Implementing an FTT would both dissuade high-risk and high-frequency trading and generate revenue to rebuild our infrastructure, improve our safety net, and make higher education affordable. Bernie has proposed that the revenue from the FTT would go towards making all higher public education tuition-free and forgiving student debt.

What has Bernie said about FTTs?

Bernie is strongly in favor of implementing an FTT in the U.S., saying that doing so “would reduce gambling on Wall Street, encourage the financial sector to invest in the productive economy, and significantly reduce the deficit without harming average Americans.”

What specific policies has Bernie supported?

Bernie cosponsored the 2013 Wall Street Trading and Speculators Tax Act, which would impose a 0.3 tax on each trade of stocks, bonds and derivatives

Bernie introduced the Inclusive Prosperity Act of 2015 and the Inclusive Prosperity Act of 2017. Both pieces of legislation proposed a small tax on each trade: 0.5 percent tax on stocks, 0.1 percent for bonds and 0.005 percent for derivatives.

Under this plan, a $1,000 stock trade would be taxed $5, a $1,000 bond trade would be taxed $1, and a trade in derivatives would be taxed $0.05. The revenue raised from this tax would be used to fund free higher-education at public institutions and to reduce student debt burdens.

Expanding the Social Safety Net & Increasing Access to Opportunity

Bernie has taken an active stance on fighting structural inequality in several ways. He supports strengthening the social safety net and increasing access to education. Here we take a quick look at each.

What does expanding the social safety net entail, according to Bernie?

This includes access to affordable housing and childcare, as well as the expansion of Social Security and nutrition programs, which you can learn more at the Public Assistance issues page.

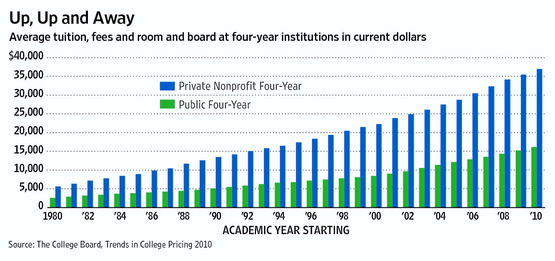

Currently, average public in-school tuition rates are over $9,000 per year. This graphic shows the change in tuition costs since 1980:

Bernie believes that no student who is willing and able to go to college should be denied an education based on the income of their parents. As a higher education is closely correlated with economic attainment, tuition-free public higher education is also a part of Bernie’s essential social safety net. The College for All Act, which he introduced, would make all public colleges and universities tuition-free. This proposal, and other education-related policies, are detailed at the Education issue page.

Bernie believes the challenges facing our healthcare system are not just structural — they’re a matter of life and death. That’s why universal healthcare is the foundation of his health care policy. Though he voted for the Affordable Care Act (more commonly known as “Obamacare”), Bernie believes that the measure hasn’t gone far enough to provide adequate healthcare for all. Check out this editorial where he passionately argues for a universal Medicare-for-All healthcare system as well as an expansion of Medicaid. Here’s a link to the Medicare for All legislation he introduced with 14 other Senators. And here are the options he’s suggested to pay for this universal healthcare coverage program.

Additionally, he’s sponsored legislation to curb drug costs and tackle fraud in the industry. His policy prizes the health and wellness of the individual over corporate profits. Learn more about all of these policies at the Health care issue page.

Creating and Keeping Better Jobs

Bernie has long fought to increase the minimum wage so every working American can live with dignity rather than fight to survive. In fact, one of the very first bills he introduced to Congress was the Livable Wage Act of 1993, a bill to increase the minimum wage which he reintroduced several times thereafter.

What’s the state of the minimum wage in America today?

Over the past 40 years, the cost of living has increased significantly while workers’ wages have stayed flat despite commensurate increases in the level of productivity. Even as the wages of young college grads have been in decline and employers continue to slash benefits, CEO pay is up nearly 1000 percent percent since 1978 (double the stock market growth in the same period). Essentially all of the new money made has gone straight to the top one percent, leaving most workers behind.

What’s Bernie doing about raising the minimum wage now?

In a statement made before a vote on a Republican-blocked budget amendment that would have raised the minimum wage, Bernie called on fellow lawmakers to “stand today with the tens of millions of workers who are struggling to put food on the table, to take care of their families.”

He is the primary sponsor of the Raise the Wage Act of 2019, which will raise the minimum wage to $15 per hour. From the start in 2015, Bernie has been on the forefront of the Fight for $15. He understands that raising the minimum wage will be a tremendous help for all workers. Some studies show that raising the minimum wage may save lives and lower the suicide rate.

Hundreds of top economists signed a letter supporting his proposal.

Bernie has taken companies like Amazon, Disney, and Walmart head-on in the battle for a $15 minimum wage. Shortly after Bernie publicly criticized Amazon CEO Jeff Bezos and Disney CEO Bob Iger, both companies increased their minimum wage to $15 an hour. In 2019, Bernie was invited to speak on behalf of workers at Walmart’s annual shareholders meeting.

Learn more at the Minimum Wage issue page.

So things are bad for everyone, wage-wise, but don’t women make even less? What’s Bernie doing to address the gender wage gap?

Women make 82 cents for every dollar men make doing the exact same job. The persistent pay gap that exists between men and women may seem small, but is not as it adds up over time. In real terms, this pay imbalance means a woman would have to work 39 extra days to earn the same as a man. Bernie recognizes the broad impact of lower wages for women.

He said, “Equal pay is not just a women’s issue; it’s a family issue. When women don’t receive equal pay for equal work, families across America have less money to spend on child care, groceries, and housing.”

Bernie wants to Adopt Equal Pay for Equal Work as a cosponsor of the Paycheck Fairness Act of 2019. In 2012, Bernie supported the Paycheck Fairness Act and helped bring the bill to a vote again in 2014. In March of 2001, Bernie cosponsored a constitutional amendment that would guarantee fair treatment and employment of women, it reads: “Equality of rights under the law shall not be denied or abridged by the United States or by any State on account of sex.”

Bernie is a cosponsor of the Equality Act, which would prohibit discrimination on the basis of sex, gender identity, and sexual orientation. He is also a cosponsor of the FAMILY Act, which would provide paid family and medical leave benefits.

Among his twelve point Economic Agenda for America, Bernie wrote that we must “provide equal pay for women workers who now make 78 percent of what male counterparts make.” In addition to these more recent efforts, Bernie voted in favor of the Lilly Ledbetter Fair Pay Act of 2009, which aims “to ensure that individuals subjected to unlawful pay discrimination are able to effectively assert their rights under the federal anti-discrimination laws.”

Pay equity is an integral part of Bernie’s platform for the 2020 presidential election. Learn more at the Equal Pay issue page.

And what about creating new jobs?

Bernie believes that the fastest way to create millions of jobs is to rebuild our crumbling infrastructure and he’s been saying so for decades.

Bernie has announced his 2019 plan to guarantee every American a job. He announced a similar work guarantee plan in 2018.

Bernie has supported unions throughout his career and continues to fight for working families. Bernie believes that in order to rebuild the American middle class, we must rebuild the American trade union movement as well as expand employee ownership and participation in the industry through worker co-ops. In 2017, Bernie was given a 100 percent Pro-Union rating by the AFL-CIO and has a lifetime score of 98%.

Bernie actually joins the picket lines and supports striking workers. “Standing with workers on picket lines is something I’ve done my entire life– that’s what I do and what I believe. Unions are my family.”

Bernie introduced the Workplace Democracy Act of 2018, which would ban anti-union laws and make it easier for workers to organize a union. Bernie introduced the Workplace Democracy Act during his very first term in Congress in 1992 and re-introduced the bill every two years for nearly a decade.

In 2017, Bernie joined Senate Democrats in supporting the Blueprint to Rebuild America’s Infrastructure plan which also called for a $1 trillion investment in infrastructure. In 2015, Bernie introduced the Rebuild America Act which called for an investment of $1 trillion over 5 years to rebuild and expand on our country’s infrastructure and to create over 13 million good-paying jobs. It would be paid for by closing corporate income tax loopholes and overseas tax havens.

Here’s Bernie talking about the 2015 Rebuild America Act:

Learn more at the Infrastructure issue page. Find out more about Bernie’s plans for creating American jobs on our Economy and Jobs page.

What’s he doing to keep jobs in America?

Bernie has led the fight against NAFTA, CAFTA, and the Permanent Normalized Trade Agreement with China.

Check out Bernie in 1993 railing against NAFTA on the House floor before voting against it:

As Bernie mentions in this editorial, these trade deals have off-shored a massive amount of decent paying jobs, and have closed tens of thousands of factories across our country. Bernie believes we should have trade agreements that invest in America, and not off-shoring jobs. Learn all about Bernie’s trade policies here,

See our Infrastructure page and Youth Employment page and Workers Rights page for more information.

How else does Bernie plan on supporting American workers?

Bernie believes that our jobs have to get better and better because happy and healthy workers will lead to increased productivity and a stronger economy. Non-professional women often must take part-time work instead of full-time work, sometimes combining 2 or 3 jobs to earn enough money to pay the bills. 66.5 percent of women and 85.8 percent of men are working more than 40 hours a week, many of them without paid vacation for leisure time, and little to no paid sick leave, forcing them to go into work sick.

Bernie supports paid medical leave, paid family leave, and is a strong supporter of workers’ rights, via unions and workers’ co-ops.

Learn more about these and more of his policies in this area at the Workers’ Rights issues page.

How does Bernie plan on supporting youths?

Bernie, along with Rep. John Conyers (D-Mich.) and Rep. Eleanor Holmes Norton (D-D.C.), announced the Employ Young Americans Now Act. This bill, which is nearly identical to his 2018 plan, includes $4 billion in grants to state and local governments to provide employment opportunities to low income youth and assistance with child care and transportation. $1.5 billion is for grants to employers, community colleges, and local organizations, for apprenticeships and on-the-job training.

See our Infrastructure page and Youth Employment page

Reforming Broken Criminal Justice & Immigration Systems

The American criminal justice and immigration systems perpetuate inequality, breeding crime and poverty instead of community and economic opportunity and must be revamped from the ground-up.

What’s the criminal justice system like in the U.S. today?

The U.S. has more people behind bars than any other country in the world, a fact Bernie calls an “international embarrassment”, particularly because our mass incarceration disproportionately affects people of color.

The majority of the U.S. prison population is male and under the age of 40, and a disproportionate amount of them are of people of color. Young black males are six times more likely to be arrested than young white males. Of black men aged 20–34 without a high school degree, 37 percent are incarcerated, while only 26 percent are in the workforce.

The hard data speaks volumes — incarceration rates among both blacks and Latinos have risen much faster than for whites:

What does Bernie want to do about fixing our criminal justice system?

Instead of criminalizing people — particularly those in disadvantaged communities of color — we should be giving people the opportunity to contribute to our society and economy. In Bernie’s words, it is an “unspeakable tragedy” that 1 in 3 black youths born today can expect to spend time in prison. It is imperative that our criminal justice system is reformed from the ground-up.

He wants to ban private prisons and keep nonviolent offenders out of jail by ending cash bail. In 2018, Bernie introduced a bill to end cash bail.

Given Bernie’s extensive record and the complexity of these issue areas, they are expounded upon in great detail at these two dedicated issue pages: Criminal Justice and Racial Justice.

What’s the deal with our immigration system and how it affects economic inequality?

Bernie feels our current immigration policies force individuals who are the backbone of the American economy — in industries as essential as agriculture, service, and construction — to live and work in the shadows. For this reason, Bernie strongly supports a “responsible path to citizenship” for the 11 million undocumented immigrants in the country today and a general restructuring of our immigration policies.

Please visit the Immigration issue page for the full run-down on Bernie’s policies and record on this important topic.